knoxville tn vehicle sales tax

The 925 sales tax rate in Knoxville. Private Passenger License PlateWheel Tax Exempt 1125.

Toyota Knoxville New Used Toyota Dealer In Knoxville Tn

The December 2020 total local sales tax rate was also 9250.

. This includes the rates on the state county city and special levels. The Tennessee sales tax rate is 7 as of 2022 with some cities and counties adding a local sales tax on top of the TN state sales tax. In addition to taxes car purchases in Tennessee.

Tennessee collects a 7 state sales tax rate. This sales and use tax guide is intended as an informal reference for clerks who wish to gain a better understanding of Tennessee sales and use tax requirements regarding motor vehicles. Last item for navigation.

Blountville TN 37617. Exact tax amount may vary for different items. The average cumulative sales tax rate in Knoxville Tennessee is 93 with a range that spans from 925 to 975.

Once a property has been scheduled for tax sale and published the cost of the tax sale preparation and publication is attached to the property. The Tennessee sales tax rate is currently. As reported by CarsDirect Tennessee state sales tax is 7 percent of a vehicles total purchase price.

This is the total of state county and city sales tax rates. The Knoxville sales tax rate is. City of Knoxville Public Vehicle Auctions are scheduled on the following dates.

The current total local sales tax rate in Knoxville TN is 9250. The state sales tax on a car purchase in Tennesee is 7. Current Sales Tax Rate.

The minimum combined 2022 sales tax rate for Knoxville Tennessee is. Private Passenger License PlateWheel Tax Exempt 1125. November 7 2022 - View vehicles list.

For more information contact the Vehicle Impound Lot at 865-215-6215. For example if you buy a car for 20000 then youll pay 1400 in state sales tax. These additional fees cannot be.

The Knox County Tennessee sales tax is 925 consisting of 700 Tennessee state sales tax and 225 Knox County local sales taxesThe local sales tax consists of a 225 county sales. 3 rows 05 lower than the maximum sales tax in TN. There is a maximum tax charge of 36 dollars for county taxes and 44 dollars for state taxes.

Individuals estates and certain trusts must pay a 38 tax on net investment income over a threshold amount individuals USD 250000 if married filing jointly USD 125000 if married. Purchasers of new and used vehicles must pay state sales tax at the rate of 7 percent and the state single-article tax at the rate of 225. 21556 per 100 assessed value.

925 7 state 225 local City Property Tax Rate. Therefore you will be required to pay an additional 7 on top of the purchase price of the vehicle. Counties and cities can charge an.

However this does not include any. The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. VTR-34 - Sales Tax on a Vehicle Purchase.

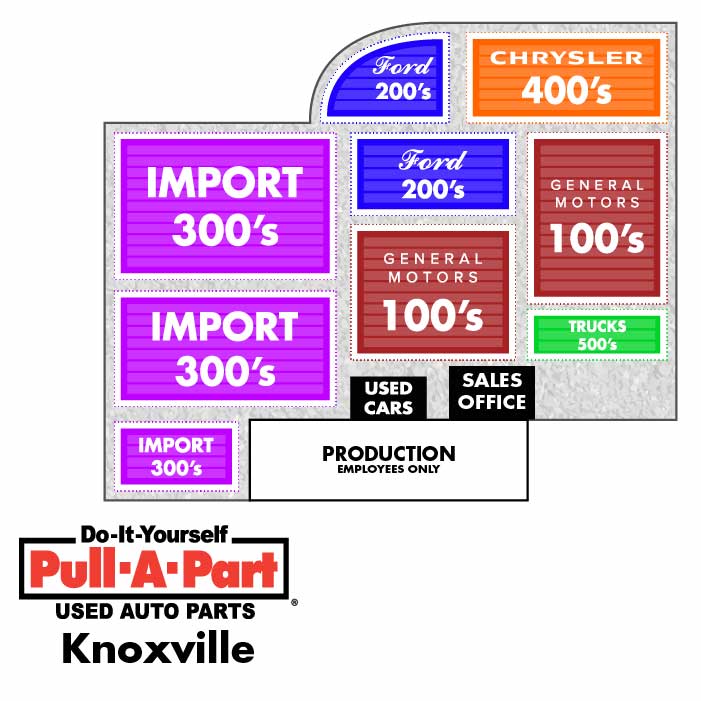

Get Used Auto Parts Used Cars At Knoxville S 1 Junkyard

New Kia Telluride For Sale In Knoxville Rusty Wallace Kia Of Knoxville

Used Cars In Knoxville Tn For Sale

Used Cars In Knoxville Tn For Sale

Used Toyota Rav4 For Sale In Knoxville Tn Cargurus

Bargain Inventory Under 10k Buy Used Cars Online Knoxville

Free Tennessee Bill Of Sale Form Pdf Word Legaltemplates

Used Jeep Cars For Sale In Knoxville Tn Cars Com

Used Gmc Yukon For Sale In Knoxville Tn Edmunds

Used Cars Trucks Suvs For Sale Knoxville Tn Morristown Oak Ridge

About Lance Cunningham Ford Knoxville Tn

Tennessee Vehicle Sales Tax Fees Calculator Find The Best Car Price

Tn Sales Tax Holiday Save Money On Groceries Guns School Supplies

Tennessee Holding Three Sales Tax Holidays For 2021 Here S What You Need To Know Wate 6 On Your Side

New Honda Passport For Sale In Knoxville Tn

Thompson Auto Sales Inc In Knoxville Tn Carsforsale Com

Used 2021 Lamborghini Huracan Evo Coupe For Sale In Knoxville Tn 37919 Usi Motors Inc